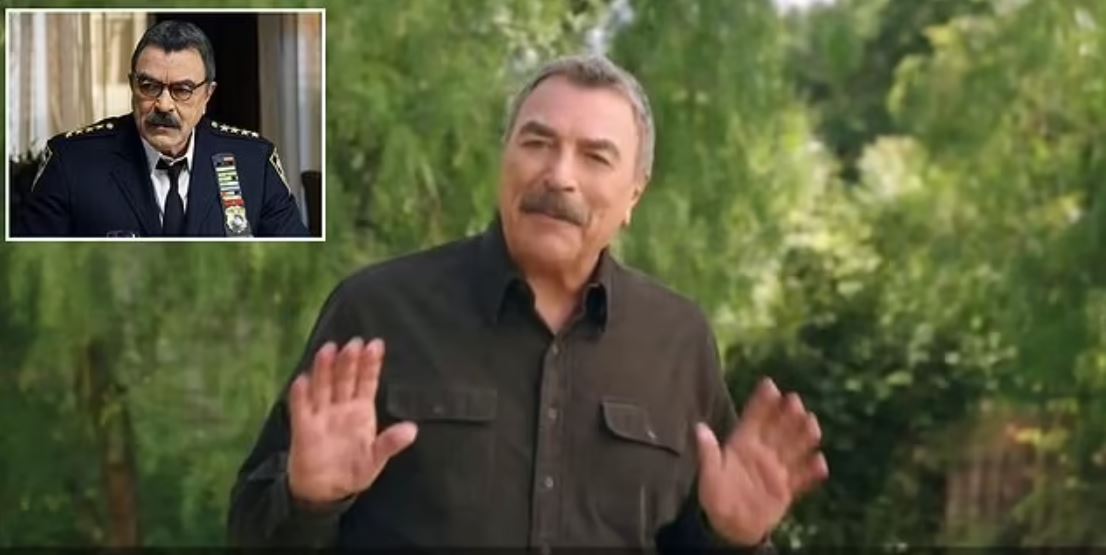

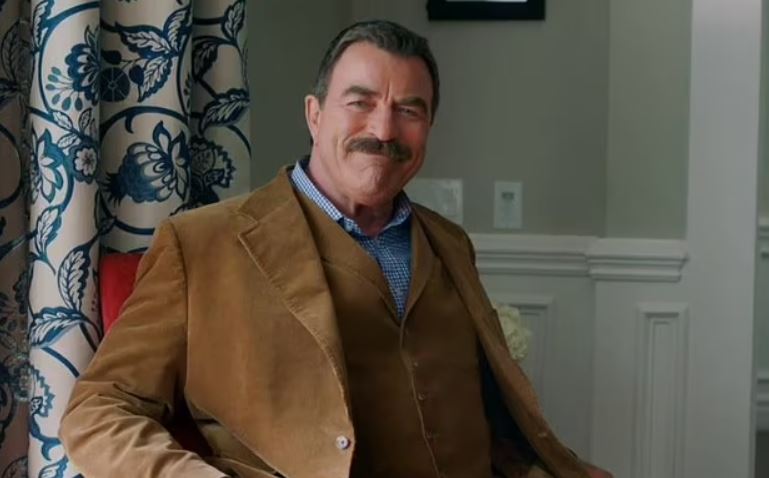

Tom Selleck, fresh off his longtime lead in CBS’s recently canceled Blue Bloods, continues to play his most controversial role: pitching loans to aging boomers struggling with their finances.

The 80-year-old Emmy and Golden Globe winner has been moonlighting since 2016 as the paid spokesman for American Advisors Group (AAG), a leading seller of reverse mortgages to older Americans.

Since the firm consolidated with and took the name of its parent corporation, Finance of America in 2023, the actor – once named Sexiest Man Alive by People magazine – has continued to allow his good-guy persona be used by a lender with an image problem.

One commenter on Reddit responded to the commercials, posting: ‘It’s predatory as hell and it’s gross that wealthy celebrities try to convince regular people that it’s helpful.’

‘Shame on him using his success to pitch these terrible loans on trusting senior citizens,’ wrote another.

A third wrote: ‘I’m Tom Selleck and I’d never advocate for anything that would hurt you. That’s why I’m here on behalf of Acme Bathtub Toasters…,’ reads one post.

DailyMail.com can reveal federal regulators have penalized the company for deceptive marketing practices, including making false promises to consumers.

They also warn consumers about the risks of reverse mortgages in general.

Reverse mortgages are special loans that allow homeowners, typically those over 60, to borrow money against their home’s equity with possibly devastating financial consequences.

Having built his fandom over decades starring in crime dramas, including the 1980s hit Magnum PI, Selleck has appeared in a series of TV commercials and YouTube infomercials aimed to convince people 62 years and older to convert their home equity into tax-free cash.

A fresh batch of the ads have aired – incessantly, some viewers might say – over the last several months.

‘Let your home take care of you,’ reads the text superimposed over his mustachioed face on Finance for America’s homepage.

The company promises that cash infusions from its loans will eliminate monthly mortgage payments, medical costs, and more,’ solving its clients’ money woes.

‘A reverse mortgage loan isn’t some kind of trick to take your home,’ the actor assured viewers of a widely-aired infomercial.

‘I’m proud to be part of AAG. I trust ’em. I think you can, too.’

But not everyone shares Selleck’s trust.

The federal Consumer Financial Protection Bureau (CFPB) took action against AAG in 2016 for deceptively making false promises that consumers who buy their reverse mortgages wouldn’t lose their homes.

That watchdog agency – which the Trump administration is now trying to shutter – fined the company more than $1million and forced it to change its advertising strategies when it failed to alter its messaging.

In 2021, the bureau again accused the company of deceptive strategies, that time for using inflated home value estimates in its marketing materials.

Consumer protection advocates have long seen reverse mortgages as fertile ground for corporate scams and predatory lending.

They note that about one in ten end in default and foreclosure, and that the rate spiked even higher in the wake of the Great Recession and Covid pandemic when many borrowers couldn’t meet their obligations to maintain repairs, insurance, and property taxes on their homes.

Watchdogs and government advisors, including those at the Federal Trade Commission, have pointed out several significant risks that anyone who’s considering such a loan should know.

Those include costs that typically are more expensive than for regular mortgages.

Among them are origination fees, which for the most common type of reverse mortgage – known as home equity conversion mortgages or HECMs – can cost either $2,500 or 2% of the first $200,000 of a home’s value, whichever is greater, plus 1% of the amount over $200,000. HECMs are insured by the Federal Housing Administration (FHA).

Although origination fees for them are capped at $6,000, those for other, less regulated kinds of reverse mortgages can run much higher.

The loans also require an initial mortgage insurance premium, which is typically 2% of a home’s value, plus real estate closing costs much like those with a regular mortgage.

Those, among other expenses, include fees for a credit check, home appraisal and inspection, plus payments for title search, recording fees and mortgage taxes.

Consumer advocates counsel borrowers against receiving reverse mortgage funds as a single lump sum rather than in regular payments for a set period or for as long as they live in the home.

By increasing a homeowner’s assets, funds from a lump sum can risk their eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI), experts warn.

Perhaps most critically, consumer protection watchdogs caution that lenders selling reverse mortgages add interest each month to the principal, and that the balance borrowers owe increases over time, potentially exceeding the value of the home.

Homeowners who don’t want that balance to increase can choose to pay the interest monthly. But those unable to do so may have limited options if they need to sell or move.

Because a reverse mortgage loan often becomes due and payable when the borrower dies, it can carry significant disadvantages for heirs who not only may inherit less if the owner’s home equity has been depleted, but also risk having to pay off the loan balance, interest, and accrued fees, typically with the proceeds from selling the home.

That leaves family members – including children, grandchildren, and even surviving spouses of borrowers – at risk for both financial debt and eviction.

Some safeguards have been put in place by federal reforms. Among them are that consumers looking to take out HECM loans must, by law, first meet with a Housing and Urban Development-approved counselor to understand the benefits and risks.

To protect against impulse borrowing, consumers also may cancel their reverse mortgages within three days of closing on their loans without having to pay any financial penalties.

Most other, non-HECM reverse mortgages don’t come with such protections.

Selleck doesn’t mention the potential downsides in his paid spots for Finance of America.

Neither Selleck nor his publicist answered the DailyMail.com’s requests for comment.

For its part, Finance of America – which claims to have sold more than $17billion in reverse mortgages – also did not respond to our inquiries.

Reverse mortgages aren’t the first product Selleck has pitched. He did voice-overs for an AT&T advertising campaign in 1993.

He extolled the virtues of homeownership in a 2012 ad campaign for Coldwell Banker.

He appeared in advertisements for the conservative National Review magazine and was a spokesman for the National Rifle Association, whose board he served on from 2005 to 2018.

He drew fierce criticism for the timing of a controversial NRA ad in which he posed with a rifle one month after the 1999 massacre at Columbine High School.

Selleck has lived since the 1980s on a 60-acre ranch in Ventura County, California that was once owned by Dean Martin.

His more than half-century of success in Hollywood makes him unlikely to need the kind of loan typically targeted at people on fixed retirement incomes who struggle to pay their bills and stay in their homes.

Selleck spent 14 years on Blue Bloods playing the role of Frank Reagan, who heads New York City’s police force and a family with multiple generations in law enforcement.

Since CBS cancelled the show last year, he has announced that he’ll appear in a new iteration of the Jesse Stone franchise, which is based on a series of detective novels.

That project is currently in development.

He began his side gig as a spokesman for Finance of America, then AAG, in 2016 after the company searched to replace the late U.S. senator from Tennessee turned Law and Order star Fred Thompson, a Republican who ran for president in 2008.

Other actors who’ve played tough, no-nonsense crime-solvers on TV have also shilled for reverse mortgage lenders.

Jerry Orbach, best known for his role as Detective Lennie Briscoe on Law and Order in the 1990s, did ads for Senior Lending Network until his death in 2004.

Robert Wagner, star of Hart to Hart in the early 1980s and It Takes a Thief in the 1960s, also pitched for that company in 2012 and 2013.

Security 1 Lending milked crooner Pat Boone’s straight-laced image to advertise reverse mortgages in 2013, and AmeriVerse Mortgage commodified the Righteous Brothers’ Bill Medley apparent righteousness to tout their products two years ago.

Henry Winkler, who played the iconic greaser Arthur ‘Fonzie’ Fonzarelli on the ’70s sitcom Happy Days, appeared in especially unrelenting ads endorsing One Reverse Mortgage, a subsidiary of Quicken Loans, from 2012 to 2018.

The message to baby boomers who came of age admiring his character’s rebellious charisma: that it’s cool to leverage their homes to pay for retirement.